Charitable Gift annuity

Charitable Gift Annuity

What Are Charitable Gift Annuities?

Charitable gift annuities have been around for a long time, but they have enjoyed a upsurge in interest in the 2000's

among both consumers and their advisors. Several factors may account for this:

• Low returns on C.D.s and other interest-bearing, fixed-income investments have made gift annuity payouts

more attractive to philanthropically inclined donors.

• Low "applicable federal rates" (AFRs) have made gift annuities more attractive to donors looking for higher

tax-free income. However, low AFRs reduce the income tax charitable deduction.

• Donors and their advisors have discovered that gift annuities are an economical alternative to charitable

remainder trusts in certain situations.

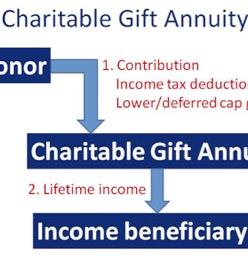

Gift Annuity Basics

A charitable gift annuity is a contractual agreement between a donor and the charity issuing

the gift annuity under which the donor makes an irrevocable gift of cash or property

(often long-term appreciated stock) to a qualified charity. In exchange for the donated

property, the charity agrees to pay a fixed amount periodically (monthly,

quarterly, semiannually or annually) for the lifetime of one or two annuitant(s).

The gift annuity transaction is not a straight quid pro quo, however. The present value of

the donor's annuity is less than the value of the property transferred. Thus, the transfer is

in part a gift to charity and in part the purchase of an annuity – and that is exactly how

federal income tax law views the gift annuity.

Only qualified charitable organizations may issue gift annuities. When so required by state law, the issuing charity must register with the state insurance departments in the states in which it solicits gift annuities. The solicitation process itself may also be subject to state regulations. State laws often require issuing charities to maintain segregated reserves to cover their potential obligations to annuitants under gift annuity agreements.

Benefits to the Donor

A charitable gift annuity offers several benefits to the donor:

• It provides an immediate income tax charitable deduction to the donor in the year the property is transferred

to charity

• It pays a lifetime income to one or two individuals, part of which is federal income tax-free.

• The income payout from the gift annuity can begin immediately or can be deferred until some future

start date.

• The charity's promise to pay the annuity is backed by the general assets of the charity.

• When appreciated property is transferred in exchange for a gift annuity, the resulting capital gains tax liability

(recognized because the transfer is in part a taxable exchange of property) can be spread over life expectancy

if the donor is the annuitant.

• The transferred assets are removed from donor's gross estate for federal estate tax purposes.

Benefits to the Charity

A charitable gift annuity also offers a number of benefits to the issuing charity:

• It can be used to make a significant one-time gift or to make a series of smaller, repeat gifts.

• It is easier to explain to donors and to implement than some alternative gift vehicles.

• The minimum gift amount often is sufficiently low to make the gift annuity accessible to a large part of the

charity's donor base.

When Does a Gift Annuity Make Sense?

The gift annuity usually makes the most sense for elderly donor-annuitants who are

philanthropically inclined--and the older the better. The tax benefits improve as the

donor's life expectancy under IRS tables shrinks. A contribution to a charity for a gift annuity is irrevocable. Therefore, it is unwise to make such a gift if it is likely that the gift property will be needed for the donor's future financial security. Often it makes sense to suggest a gift annuity to the client who intends to make a

bequest to charity. The client gains both current income tax savings and a favorably

taxed lifetime income. Because charitable gift annuities can significantly minimize capital gain taxes on the donated property, they can be attractive to clients who are considering the sale of highly appreciated property to make the donation. A client who is providing support to aged parents may find that creating a gift annuity for the benefit of parents can help provide for their income needs while generating a charitable deduction for the client.

Ground Rules for Issuing Gift Annuities

Gift annuities are an exception to the general rule [IRC Sec. 501(m)] that charitable organizations cannot issue

commercial insurance contracts if they want to keep their income tax-exempt status. To qualify for the exception, charities that issue gift annuities must comply with the so-called "Clay-Brown" rules [IRC Sec. 514(c)(5)] to avoid being taxed on the revenues they receive from gift annuities. These rules are:

• The present value of the annuity must be less than 90% of the total value of the property transferred in

exchange for the annuity.

• The annuity cannot be payable over more than two lives, and the life or lives must be in being at the time the

gift annuity is set up.

• The gift annuity agreement between the donor and charity must not specify either a guaranteed minimum

number of annuity payments, or a maximum number of payments.

• The amount of the periodic annuity payments cannot be subject to adjustment by reference to the actual

income produced by the transferred property or any other property.

Income Tax Charitable Deduction

A charitable gift annuity is technically part-gift and part-sale (i.e., a bargain sale) since the donor contributes the

property in exchange for annuity payments from the charity. The donor receives an income tax charitable

deduction in the year of the gift for the gift portion of the transfer (i.e., the value of the contributed cash or

property less the present value of the annuity payments).

If cash is transferred for the annuity, the percentage limitation is 50% of adjusted

gross income (AGI). If long-term appreciated property is transferred, the percentage

limitation is generally 30% of AGI. Any deduction in excess of the applicable percentage

limitation may be taken in up to five following tax years. The donor may

make the

special election to reduce the amount of his contribution by the appreciation in the

property in order to be eligible for the 50% limitation. The election could make

sense if (1) the appreciation element is small, or (2) the donor needs a large deduction

in the current year. A gift annuity payable to two annuitants for their joint lives will result in a reduced

income tax charitable deduction. The payout period for two annuitants can be expected to last longer than for a

single annuitant, and this will boost the present value of the annuity.

Selecting the Applicable Federal Rate

The Internal Revenue Code requires an "applicable federal rate" (AFR) to be used in calculating the charitable

deduction for gifts of partial interests in property, including gift annuities. Toward the end of each month, the government issues a revenue ruling that provides a table of rates for the following month. The pertinent rate from

this table is:

120% of the applicable midterm rate, rounded to the nearest two-tenths of one percent.

The rates in the government's monthly tables are adjusted for monthly, quarterly, or semiannual payouts. The rate for the month of the contribution, or the rate for either of the two preceding months, may be used. The AFR selection decision is more complicated for gift annuities than for other gift vehicles because there's a tradeoff involved. A donor who wants to maximize his or her deduction will select the highest rate available. This reduces the value of the annuity and increases the amount of the charitable gift. But a donor who wants to maximize the federal income tax-free portion of the annuity payments will select the lowest available rate—keeping in mind that this will reduce the charitable deduction.

Income Payout To Annuitant(s)

Naming the Annuitant

The annuitant is the individual designated by the donor to receive the income payouts from a gift annuity. The

donor can name himself as the sole annuitant, another individual as sole annuitant, joint-and-survivor annuitants, or consecutive annuitants. A maximum of two annuitants is allowed.

Term of the Annuity

The income payout period of a charitable gift annuity must be measured by one or two lives. The annuity

cannot be:

• payable for a fixed term of years rather than the annuitant's life;

• guaranteed for a minimum number of years; or

• terminated when a maximum number of years is reached.

Annuity Payout Rates

The fixed annuity amount paid by the charity to the annuitant is based on a payout rate established by the particular

charity. The payout rates, in turn, are based on the age of the annuitant. Generally, the older the annuitant, the

higher the payout rate. The present value of the annuity must be less than 90% of the value of the property transferred in exchange for the annuity or the transaction will fail to qualify for an income tax charitable deduction.The American Council on Gift Annuities (ACGA), a voluntary organization with charitable organizations as its members, publishes a set of suggested payout rates. These rates are revised periodically as prevailing interest rates fluctuate and mortality trends change.

Price-Fixing Challenge to ACGA Rates

The ACGA's suggested payout rates were attacked as price-fixing in a class-action lawsuit in 1995, but Congress passed legislation in 1995 and 1997 generally exempting gift annuities from federal and state antitrust and securities law restrictions. To comply with this federal legislation, charities usually send a disclosure letter to donors/annuitants.

Income Taxation of Gift Annuity Payouts

The annuity paid by the charity under a gift annuity contract may be taxable as:

• a tax-free return of principal,

• long-term capital gain, and

• ordinary income.

Return of Principal

A portion of each payment received by the donor or other annuitant will be a tax-free return of principal until the assumed cost of the annuity (as determined under IRS tables) has been fully recovered upon the annuitant's attainment of life expectancy. The assumed cost of the annuity does not include the portion of the transferred property's value that is assigned to the gift portion of the transaction. The donor's cost basis must be allocated between the gift and sale portions of the transaction in accordance with their respective proportions of the value of the property transferred. For example, if the gift portion represents 60% of the total transfer, then 60% of the donor's basis must be allocated to the gift and is not available to offset the gain on the sale portion.

Capital Gain Portion

If long-term appreciated property is transferred in exchange for a gift annuity, a portion of each payment will

be taxed as long-term capital gain until life expectancy is reached (and as ordinary income thereafter). Any

long-term capital gain portion of the gift annuity payments will be eligible for the special 15% tax rate on longterm capital gains. Also, any capital gain portion of the payments will reduce the income tax-free portion of the annuity payments. Capital gain is recognized only on the sale portion of the transaction (and with the basis allocation just described). Under general tax rules, this gain would be recognized all at once in the year of the transaction. But a donor may spread the gain over life expectancy provided:

• the donor is the sole annuitant, or

• the donor and another individual are the only annuitants.

Ordinary Income Portion

After the capital gain and tax-free portions of an annuity payment have been determined, the balance of the payment represents ordinary income. If and when the annuitant(s) attain life expectancy, all principal attributable to the sale portion will have been recovered federal income tax-free, and all capital gain attributable to the sale portion will have been recognized. Thereafter, the annuity payments will be fully taxable as ordinary income.

Gift Taxation of a Charitable Gift Annuity

The creation of a gift annuity results in a gift to charity and to any third-party annuitant who may be named. If

donors name themselves as annuitants, they do not, of course, make a gift to themselves.

Gift to Charity

The present value of the charity's interest in a gift annuity is eligible for the gift tax charitable deduction. This

deduction is unlimited in amount, unlike the income tax charitable deduction, which is subject to percentage limitations

that may cap the deduction.

Gift to Third Party

If the third-party annuitant is the donor's spouse, or if the spouse is named as a concurrent and/or successor

annuitant with the donor, the gift tax marital deduction may be taken for the life-income gift made to the spouse.

If the third-party annuitant is someone other than the donor and/or the donor's spouse, a gift is made at the time

the gift annuity is established equal to the present value of the individual's lifetime annuity. This gift is of a present interest, if payments begin within one year, and qualifies for the gift tax annual exclusion.

However, if the donor retains the right to revoke the third party's annuity interest at any time, then there is no

immediate gift. Rather, each annuity payment is a completed gift in the year received by the annuitant. If the donor retains the power to revoke only by his or her will, then there is a completed gift at the time of the contribution. This gift is the present value of the annuitant's life-income interest as measured by the donor's life expectancy rather than the annuitant's. The gift tax annual exclusion also would apply in this case.

If the annuity is payable to the donor for life, then to another (non-spouse), a power of revocation reserved by the donor will avoid a completed gift until the donor's death—assuming that no actual revocation occurs and that the other annuitant survives the donor.

Estate Taxation of a Charitable Gift Annuity

The federal estate tax consequences of a gift annuity generally depend on whether the donor names himself/herself or another as annuitant, and whether the annuity is for one or two lives.

Generally, the present value of any individual survivor annuity is included in the deceased donor's gross estate. If there is no remaining annuity payable at the donor's death, then nothing is includible in the gross estate. Any taxable gift that the donor made at the time the gift annuity was set up—that is, the value of a third-party annuitant's interest—will come back into the donor's estate tax base as an "adjusted taxable gift."

If the donor designated himself as sole annuitant, the amount includible in his gross estate at death is the value of any annuity payment due but unreceived at the time of death. If the donor designated a third party as sole annuitant, and did not retain the power to revoke the annuitant's interest, then the remaining value of the annuity at the donor's death is excluded from the donor's gross estate. However, the taxable gift that resulted at the time the gift annuity was set up will be added to the donor's estate tax base as an "adjusted taxable gift" [IRC §2001(b)].Suppose the donor did retain a power to revoke a third-party annuitant's interest to avoid making a taxable gift at the time the gift annuity was set up. The donor's revocation power is a "string" that pulls the annuity back into his gross estate at death. The present value of the remaining payments under the annuity is the amount includible. If and to the extent that the annual payments received by the annuitant during the donor's life constituted taxable gifts as received, they will show up in the donor's estate tax base at death as "adjusted taxable gifts." If the third-party annuitant is the donor's spouse, the value of any remaining payments apparently qualifies for the estate tax marital deduction, according to tax regulations, even though this seems to be a terminable interest of the type usually disqualified for the estate tax marital deduction [see Reg. §20.2056(b)-1(g), example (3)]. Suppose the donor transfers her separate property in exchange for a gift annuity, and names herself and her husband as joint-and-survivor annuitants. She reserves a power to revoke his interest in order to avoid making a taxable gift when the transfer occurs. If her husband outlives her, the present value of his survivor annuity will be includible in her gross estate and will be eligible for the marital deduction. If she is the last to die, no survivor annuity remains to be taxed at her death—only the value of any payment due and unreceived when she dies. An interesting "quirk" in the federal estate tax treatment of gift annuities is that the charitable gift portion of the original transfer is not included in the donor's gross estate. This contrasts with the treatment of a charitable remainder annuity trust (CRAT)—a gift vehicle similar to the gift annuity—in which the full value of the trust is includible in the donor's gross estate if the donor retained a life-income interest in the trust or a power to revoke the income interest of another. The present value of the CRAT's charitable remainder washes out of the estate tax base as an estate tax charitable deduction.

Deferred Gift Annuities

In the conventional gift annuity arrangement, annuity payments begin no later than one year after the gift has

been made. However, many high-earning donors do not need or want additional income immediately. Instead,

income tax relief may be more important to them at their stage of life.

A deferred gift annuity lets donors defer the starting date of annuity payments and thereby significantly

increase both the annuity amount and the income tax charitable deduction—which is still available in the year of the contribution. Deferred gift annuities may be an attractive supplement to IRAs or other retirement plans and can potentially be used to increase retirement income.The American Council on Gift Annuities publishes a table of factors for adjusting

the annuity payout in the case of a deferred gift annuity. These factors are

based on the length of the deferral period. Commercial software packages

build these factors into their calculation codes so the adjustments are made

automatically when deferred gift annuity calculations are run.

The bottom line is that the donor can get more income tax relief during highincome

years and a higher income stream later on when, presumably, the

donor will have a greater need for supplemental income.

To summarize, the advantages of the deferred gift annuity include:

• a current federal income tax deduction,

• additional income for retirement, or a grandchild's college tuition, or other

purposes, and

• a favorably taxed lifetime income after payments begin.

Deferred gift annuities may be an attractive supplement to IRAs or other retirement plans, and can potentially be used to increase retirement income.

Flexible Start Date for Deferred Gift Annuities

Deferred gift annuities may include a provision in the gift annuity agreement that allows the annuity starting date to be determined in the future. The IRS has approved a deferred gift annuity that did not specify a fixed starting date for the annuity payments [Ltr. Rul. 9743054]. The donor established the annuity at age 50, and could elect to have payments begin at any time after age 55.

The gift annuity agreement between the donor and the charity specified a different payment amount (rising with the deferral of the start date) for each possible age at which payments might begin. The income tax charitable deduction allowed for the gift was based on the lowest possible deduction that would be available at the earliest annuity starting date. This letter ruling technically applies only to the donor involved therein, but it is generally believed that the IRS will look with favor upon similar cases in which donors seek to preserve some flexibility in setting their annuity starting date—and who are willing to take a lower upfront deduction.

College Funding with Deferred Gift Annuities

Deferred gift annuities may include a clause, known as a commutation clause, that allows the deferred income to be paid in a shortened period of time rather than for an entire lifetime. This option is helpful when the annuitant needs more income during a particular period of time, such as during the college years.

Types of Property Contributed

Cash

The contribution to a charitable gift annuity may be in cash. Cash gifts for a gift annuity result in more tax-free

income than non-cash gifts.

Long-term Appreciated Stock or Mutual Funds

If appreciated property held for more than one year is used to fund a gift annuity, the appreciation that has never been taxed will help to generate the charitable deduction and the annuity payout. This will produce a more favor-able result than selling the appreciated property, paying the tax on the gain, and using only the net proceeds to make a cash transfer.

Illiquid Property

Generally, "hard-to-market" or "hard-to-value" property, such as tangible personal property, closely held stock or real estate, is not appropriate to fund a gift annuity, at least not from the charity's point of view. The charity is obligated to pay a fixed amount to the annuitant based on the valuation at the time the gift annuity is established, even

if the property is subsequently sold for less than the original value—or no ready buyer can be found at all.

Real Estate

Some states (New York, for example) prohibit a charity from issuing a gift annuity in exchange for real estate.

Consult an attorney for any restrictions applicable to real estate in your state.

Mortgaged Property

Transferring property that is subject to a mortgage or other encumbrance for a gift annuity can create tax

problems for both the donor (e.g., debt forgiven is added to the donor's recognized gain) and the charity (e.g.,

unrelated business taxable income from debt-financed property).

Comparing Gift Annuities with Charitable Remainder Trusts

The view has been expressed in planned giving circles that donors often have used charitable remainder trusts

(CRTs) when gift annuities could have accomplished the same results with less expense and complexity. Some of the disadvantages associated with CRTs include:

• Attorneys' fees to research any tax issues and prepare the CRT instrument;

• Trust administration hassles and fees, including accounting for trust income, filing tax returns, and reporting

income to beneficiaries; and

• Possible management fees for CRT investments.

However, certain donor objectives are not possible with a gift annuity and may only be achieved with a CRT:

• The donor wants to be able to change the charitable remainderman or to designate more than one charitable

remainderman.

• The donor wants the payout period to be measured by a term of years (up to 20), rather than by the annuitant's

life expectancy (perhaps to boost the amount of the charitable deduction).

• The donor wants to fund the gift with real estate, closely held stock or other illiquid assets that may not be

permissible or suitable for a gift annuity.

• The donor wants the payout to grow with the value of trust assets, which is possible with a charitable

remainder unitrust.

• The donor wants the flexible payout schedule possible with a net income unitrust, NIMCRUT or flip unitrust.

• The donor wants to name himself as trustee of the CRT.

Beyond these general considerations, the following specific areas could affect the donor's selection of a life-income gift vehicle.

Income Security

A charitable gift annuity provides the greatest income security for the annuitant in that a charity's general assets

stand behind its promise to pay the annuity. By contrast, with a CRT, only the trust assets stand behind payment of the annuity amount or unitrust amount. Moreover, the payouts will vary with investment performance in a unitrust.

Duration of Payments

A gift annuity must make payouts measured by the life of one or two annuitants, whereas the duration of CRTs can be measured by a term of years (up to 20), as well as by the life or lives of the noncharitable beneficiaries. Moreover, CRTs can be arranged to last for more than two lives if the 10 percent minimum charitable remainder test is satisfied at trust inception (and for each addition to the corpus in the case of a unitrust).

Complexity

Donors may feel less intimidated by the relatively simple gift annuity arrangement than by a lengthy, complicated CRT document and strange new vocabulary such as "unitrust amount" and "remainderman." Implementation of a CRT requires the assistance and expense of an attorney. Likewise, the administration of a CRT may require professional expertise.

Flexibility

CRTs, however, offer the donor greater flexibility in gift design (especially in payout alternatives) than is available with a gift annuity. The unitrust, in particular, offers several planning options that can be adapted to the donor's individual circumstances and philanthropic goals.

Similarly, a CRUT of the net income, NIMCRUT or flip variety can receive assets that may not be suitable for a gift annuity. For example, some charities cannot, by local law or institutional policy, accept a gift of real estate in exchange for a gift annuity. But real estate might be appropriate for funding one of the unitrust options.

Minimum Size of Gift

In most cases, a charitable remainder trust is feasible only for larger gifts of several hundred thousand dollars. The gift annuity can be funded with smaller amounts (each issuing charity establishes its own minimum), and gift annuity donors often make repeat gifts. Additions to corpus are possible with charitable remainder unitrusts but not with annuity trusts.

Taxation of Payouts

Finally, favorable taxation of payouts is more or less automatic for gift annuities but not CRTs. The four-tier system for taxing CRT distributions presumes that the most heavily taxed income is the first to be distributed from the trust. So the income beneficiary will not receive long-term capital gain, tax-free income or return of corpus until all ordinary income and short-term capital gain have been distributed.